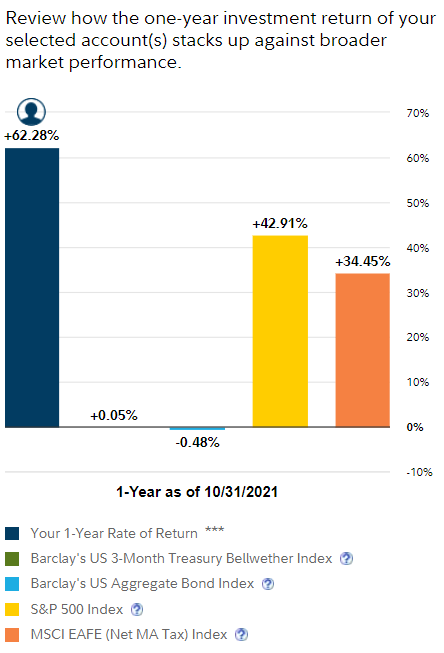

It’s been a few weeks since I last posted. I was honestly nervous about the markets, and was also just busy with life, and that’s the way it goes for a retail trader. I truly had my doubts and for a minute there I was almost right, and then the markets took off again.

About 2 months ago I bought SPY Puts when the S&P was at about 4500. One was purchased for a 5% market drop at a strike of 422 with an execution on 11/19/21, and the other was for a 10% drop at a strike of 410 for 1/21/22. I had bought these at the top. I thought I nailed the call. I was on a flight to Austin Texas and the market dropped nearly 2% in a single day for a total of about 3%. Now I am not rooting for a market collapse, but I do like to be right. And you also need to hedge against a downward move when you’re convinced it’s in the cards.

Well, here I was thinking I was the smartest guy around. I timed it perfectly, or so I thought. I had pulled most of my money out of the market, leaving some of the positions I thought would be okay, mainly energy and mining companies, thanks to everyone’s love with EV’s and TSLA.

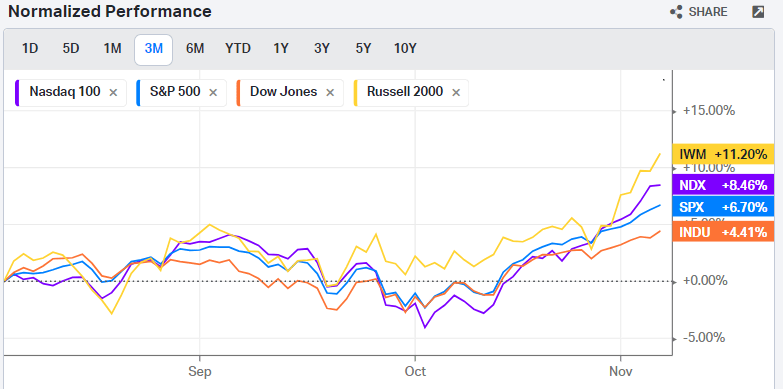

Whelp! Here I am a few weeks later and the market has once again shot up to new highs. So, here I am, back trying to ride the wave up. Now I am not 100% sold on this renewed bull run, but I have serious FOMO, like most people watching the markets when they don’t have much “skin in the game”.

“Don’t Fight the Fed”, it’s been the motto since they slashed rates and pumped the economy full of cash. The Fed basically said they won’t rate hike until mid 2022, giving people more time to react to a hike, and give people this false sense of security. I mean the only reason J-Pow needs to give people insight into these rate hikes is the fact that the market is so fragile. Yes the market keeps going up, yes things continue to hit all time highs, however rates literally can’t go lower, unless we went full tilt like the ECB and go negative. The economy is sitting on a foundation of debt, and the slightest rate hike would bring it crashing down to it’s knees. And that’s the last thing J-POW or the people in office want to see.

So what did I do? Well, I decided to be irrational like the markets. I finally dipped my toes in some of the FAANG stocks. Just a bit, nothing that would cripple me, if they lost any sort of case against them regarding data privacy. GOOGLE, Apple, and Tesla. Yes, I still think TSLA is ridiculous, but I might as well throw a couple lucky pennies into the good luck fountain.

In the end, I am being bullish when it is time to bullish. I mean look at how far these indexes decided to rip after going down 3%. We’ve got supply chain issues, inflation, and economic issues and this market still keeps pumping. So, might as well join the party until somebody calls the cops.

Some of my favorite hopefuls in the bag currently:

- LAC- A lithium mining company. This thing has been humming along as all the news of TSLA and EV’s comes about.

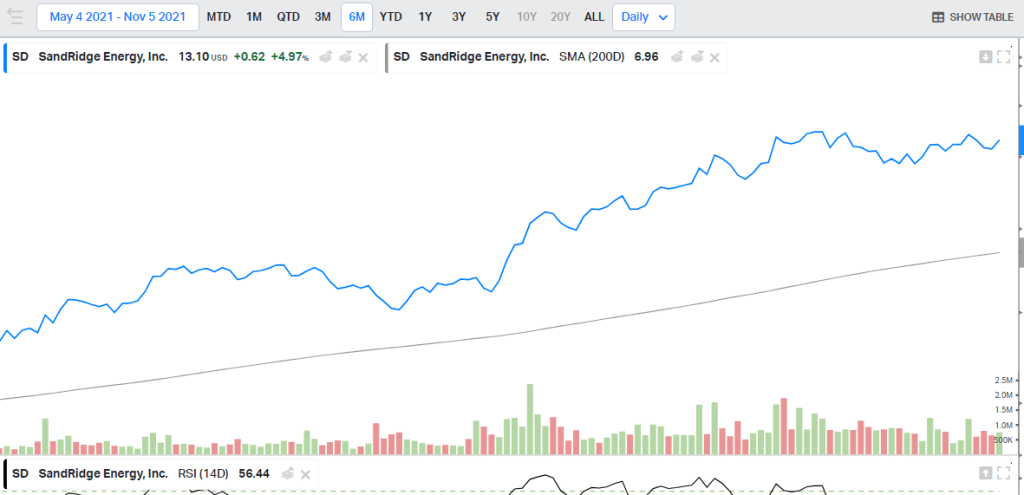

- SD- Sandridge Energy, a small oil company that almost went bankrupt but has a lot of assets keeping it’s value afloat. Oh and also, Gas has shot up to $90 a barrel

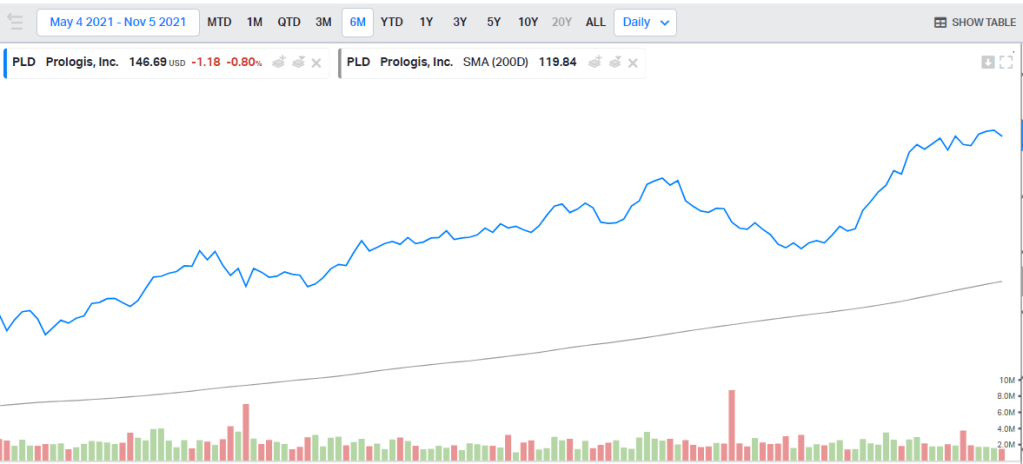

- Prologis- Literally one of the safest, most steady climbing stocks I think you can find. As long as there is logistics and a continued boom with ecomm as well as warehousing, prologis is key. It is a massive real estate owner that rents warehouses.

As Always, None of the information in this blog is financial advice and is the sole opinion of the author. You should always consult a finance professional when making any financial decision.

Good to see your new post.

LikeLike