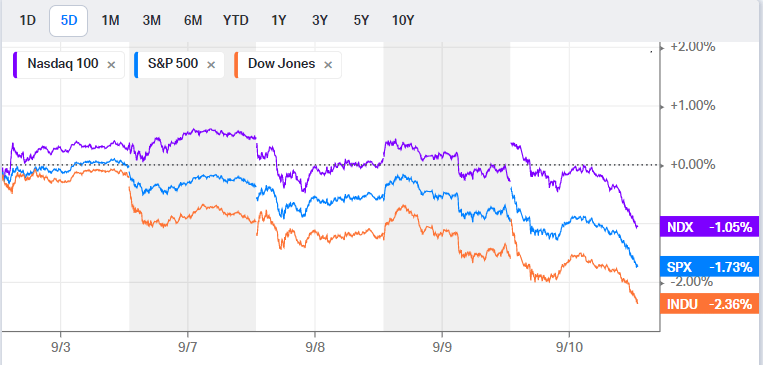

It’s been a few weeks since I last posted. That is primarily due to the fact I have not had much confidence in the market. The 2 weeks after I posted there was an overall increase in stock market performance. However, this past week the market saw 5 days of down markets. See below charts for reference.

After my last post I sold off a variety of my holdings. There is definitely a shift in outlook on the market and some key fundamentals that have been holding it up have ended.

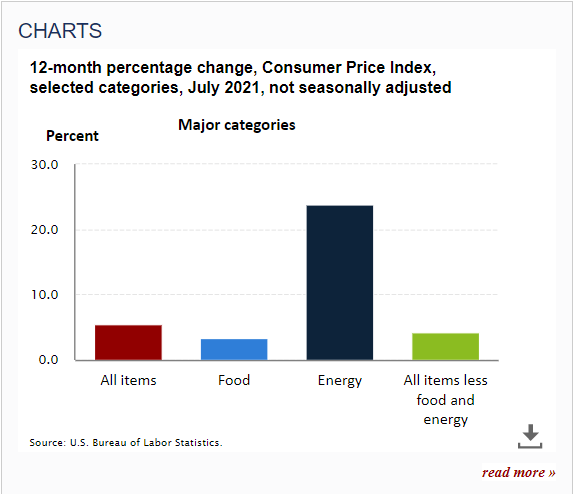

The foreclosure moratorium ended on 7/31 and the mortgage moratorium will be ending on 9/31/21. Additional unemployment benefits put into place last year, ended on labor day weekend. Inflation is still running higher than normal and has not stabilized yet. This is due largely in part to continued supply chain disruptions across the globe. Ports remain backed up with a week of freight sitting offshore waiting to be unloaded at any given time.

The Fed earlier this month came out and said they will begin Quantitative Tightening by reducing the amount of bond that it buys. The Fed has been purchasing more than $120 billion a month since stepping in to keep the economy afloat during covid. The purchase of these bonds has allowed an influx of additional money into the financial system, while keeping interest rates near zero.

With all of this said, I have cautioned myself toward the outlook of the market the next few months. I did purchase some stocks that were hot, including a Uranium ETF that shot up the last few weeks. This is as a result of speculation from the Infrastructure bill as well as various projections around the globe of increased nuclear energy production. There are only so many energy sources that have zero greenhouse gas emissions, with nuclear energy being one that may be under-utilized.

Another stock I decided to go into was Pangaea Logistics (PANL). They currently have a fleet of 22 ships with 50% working in Ice regions which allow for less CO2 emissions and a quicker run time. With Supply Chain disruptions across the globe, carriers have a large advantage over their customers, leading to higher prices and revenue. The otherside to that is an increase in fuel prices which can offset some of that revenue. In current state though, I do not see the supply chains freeing up anytime soon, so I think these carriers will continue to see solid earnings performances. PANL has beat earning expectations the last 3 quarters.

My strategy for the time being is:

- Don’t be over invested. It’s okay to sit on some cash and weather the storm that might be headed this way.

- Be selective. Buy stocks that are underpriced and have not been riding the wave up for the last 12 months. There are a lot of overpriced stocks out there.

- When I do go into a trade, go in with confidence. I’ve learned that if you go in small, and get it right, you’ll have regrets about the size.

- When you do go in big, know when to get out. If the trade starts going south, know when to take the loss. Have those limits in place allow for limited losses vs. the potential upside.

Nice article. Looks like you are doing lots of research.

LikeLike