Week in Review:

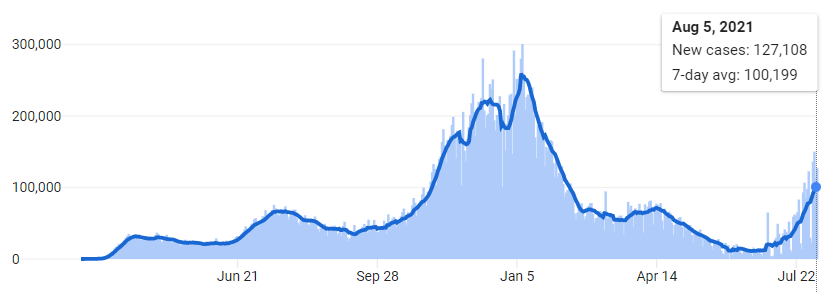

- The Covid-19 and particularly the Delta variant continue to increase infections in many parts of the U.S and around the world.

Current trend of cases in the U.S.

2. Robinhood IPO took place. The volatility of the stock in it’s first week has been exactly what I suspected. It was the main platform for the AMC and GME frenzies that took place earlier this year and now it appears to be the target itself now. I personally do have a small size account in Robinhood that I use for fun quick purchases and bought small amount, because why not?

3. Victoria’s Secret (VSCO) and Bath and Body Works (BBWI) broke off from each other and began trading individually on the market. Victoria’s Secret is going through a re-branding/re-imaging of the company. They cancelled the Victoria’s Secret fashion show in 2019, and have been working to be a more inclusive company. In my opinion I do see a lot of upside in the VSCO allowing a more diverse product line, and decided to buy some for myself.

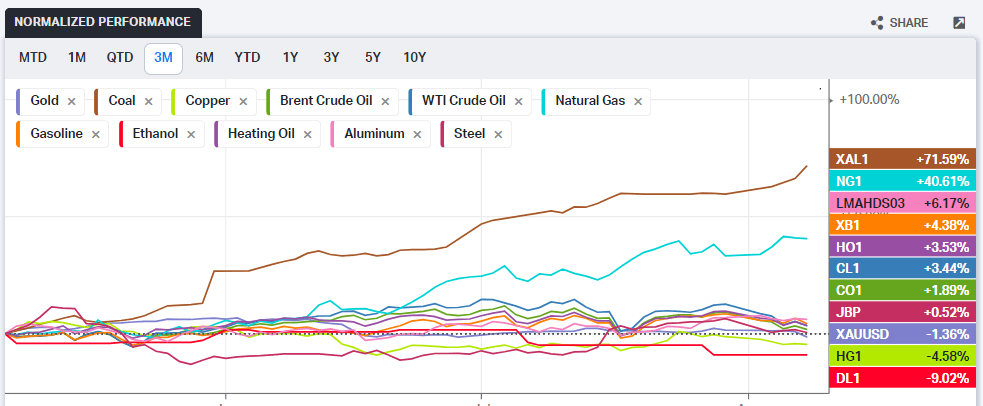

A few weeks back I was looking through and comparing commodity performance over various time periods and the one thing that really stood out was a commodity I never suspected. COAL. I actually posted a picture on my Instagram story about “Who is buying all the coal?”.

This idea got me interested in actually finding out, why is the price of coal going up? This got me thinking about the energy sector as a whole and what does that look like? Below is the chart that really caught my attention, over the last 3 months most commodities have been relatively stable, however coal has really taken off over 71%. Isn’t this supposed to be a dying source of energy?

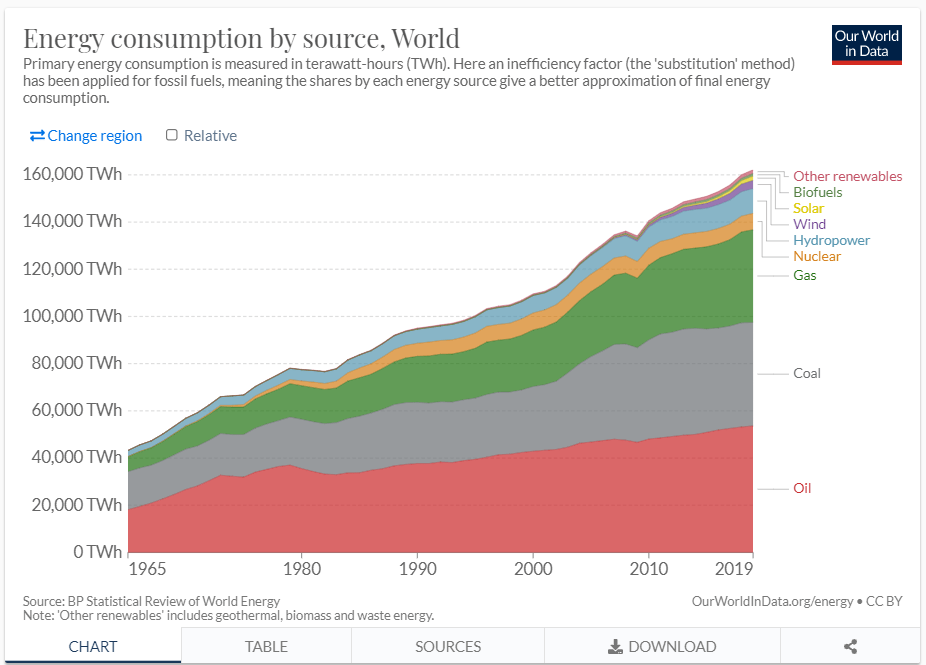

My first instinct was to look at the energy sector as whole. And for the tree huggers out there, and honestly really anybody who lives on this planet, you may be a little shocked at the findings. The chart below is Energy consumption by source throughout the World. As you can see, coal is still a major source of energy for the world. And while we keep being informed of all these alternative energies and the perception that is presented saying coal use is decreasing is in fact wrong. Over the last few years coal has actually been pretty stable in it’s consumption and has not been decreasing. The share of overall energy consumption of coal has dropped but that is because we are using more energy from the other sources. https://ourworldindata.org/energy-mix

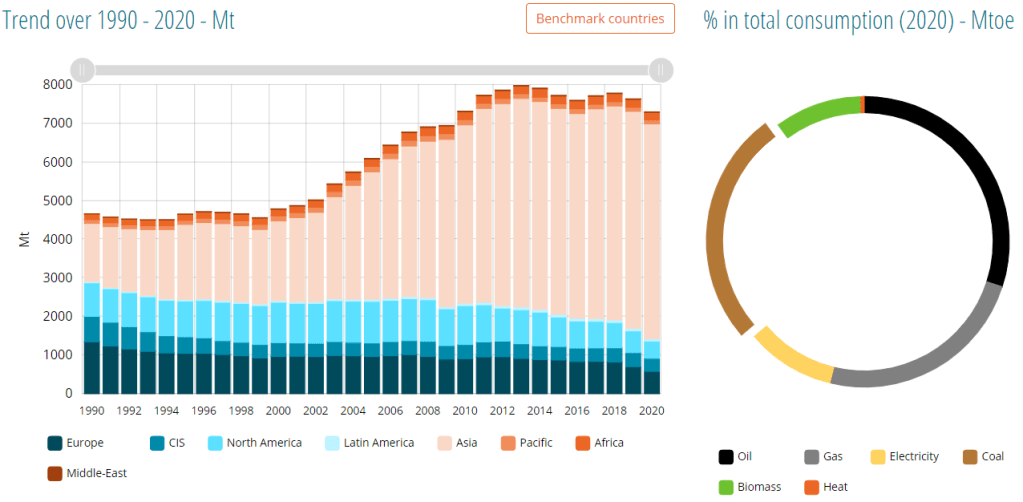

My next thought after seeing this was, why is the price of coal going up now? Coal didn’t all of a sudden become the new energy of the future, so what happened? Below is a breakdown by region of the world and the consumption of energy by type. As you can see, in 2020 we used less energy since 2010, which makes sense since we were not at 100% operating capacity across the world. However, now in 2021 production has ramped back up

The conclusion I have drawn is based on a few things. Natural gas prices are rising due to a constrained market and increased demand for natural gas. As natural gas has increased, and another energy source was needed at a lower cost, coal was the next best alternative.

There have also been multiple events around the world that have contributed to this quick rise in price. There is currently a ban in place disallowing Australia to export coal to China, as well as a hydro electric power dam outage in China, as well as a coal mine shut down in Columbia due to a pipeline in the area being turned off.

https://www.ft.com/content/b696720f-fed4-4f4b-acbd-302f8935c73e

What I take away from all this is not to invest in coal mining or coal futures. While it could possibly be a short term profit, I take it as how much opportunity and room for growth we have for natural resources. Looking at the chart from ourworldindata.com, natural resources are just a tiny sliver of the overall energy consumption in the world. Also, as the 1 trillion dollar infrastructure deal works it’s way through the government for approval, there is a lot of opportunity in the expansion of this in the U.S and there are many companies that will end up benefitting from this deal.

Very interesting comments on coal.

LikeLike