Currently I have brain fog from having a newborn child at home so if this post makes no sense at all…. I blame that.

Recently I tried to use what little free time I have while the baby was sleeping to do some research on the stock market. Now I am not going to sit here and lie, I thought we would have had significant pullback by now. I was more bearish than the market, and I was punished for that by accepting my measly 5% CD’s over the last few months, with a few dollars in various stocks.

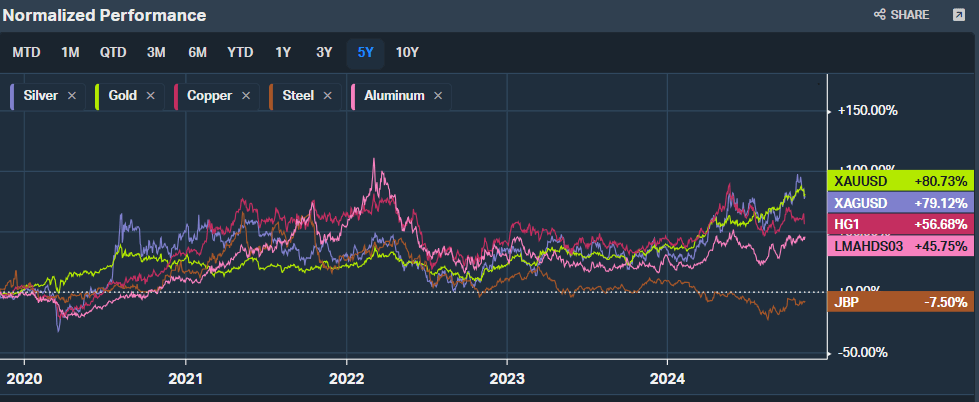

However, one piece of metal caught my eye and it was the pricing of Aluminum. Now some of the stocks I did purchase were for other commodities such as precious metals, oil, and Uranium. These have been pretty boom and bust the last few months so I needed to switch things up. These commodities were all over the mainstream media and Twitter feeds of the gambling degenerates. This should have been my first fair warning, since laser beam eyes of neon green or oil barrels are a key indicator of a saturated market. However, no one has Diet Coke Can laser eyes in their profile pictures.

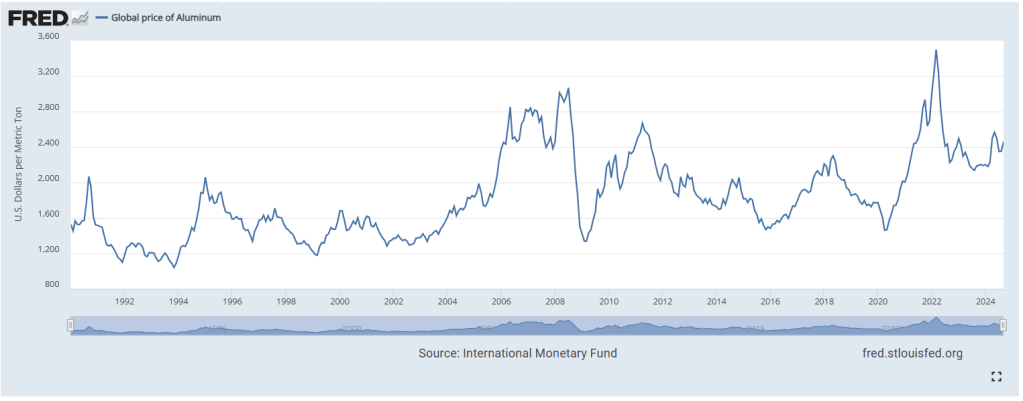

Here is what I was looking at when I saw the trend in aluminum. You can see in 2022 there was an incredible spike in Aluminum prices coming out of 2020 and 2021. Since then we had a reversion and have been consolidating for about 2 years.

Now, once again there is some new activity going on in aluminum prices.

Below you can see the YTD price of aluminum from 2200 range and now hovering in the 2400-2500 range.

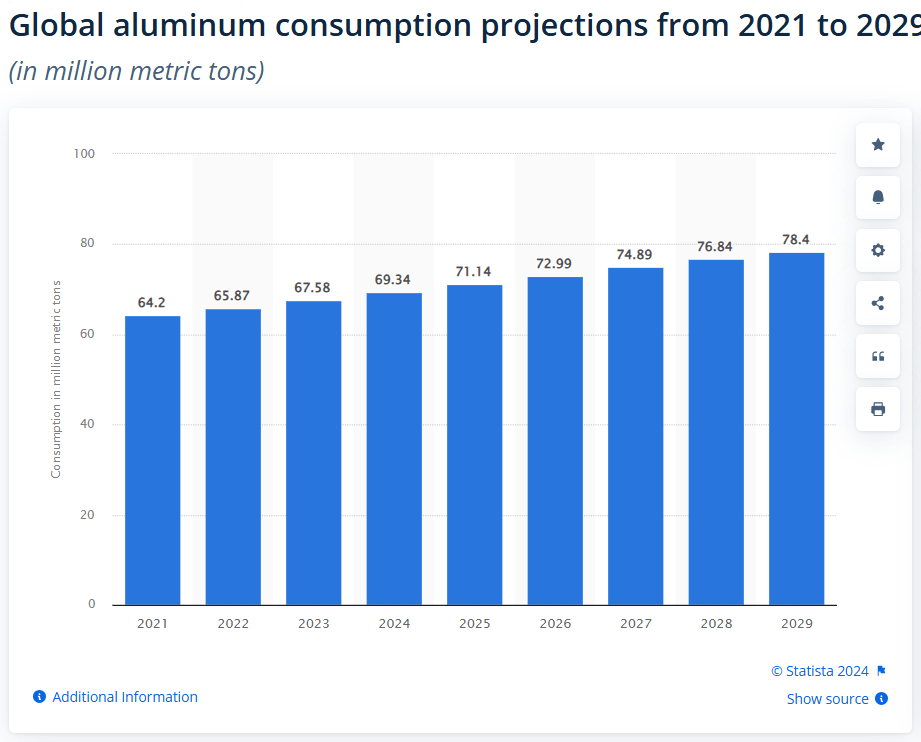

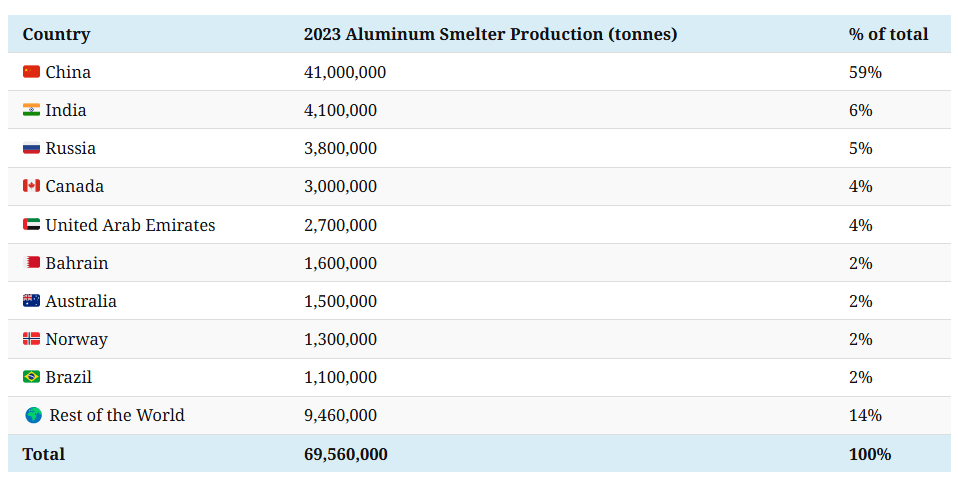

Over the next 5 years aluminum consumption is expected to increase by 13%. Below is the breakdown of Aluminum production by country with a clear leader in China, producing almost 60% of global production. With the election that took place in the U.S. and the policies Trump wants to put in place, getting into an economic trade war can be an inflationary environment for this resource. China is also nearing physical capacity of production and global aluminum production will need to expand in other parts to accommodate. The main drivers of this production is EV manufacturing, growth in aluminum packaging expected to grow by 3M tons per year by 2030, electrification of urban areas as well as green initiatives in other countries.

As I thought through this trade last week, I ended up buying the stock Century Aluminum (CENX).

I was skeptical to buy the stock at first because I had done limited research, and their earnings we to take place on 11/4, just a few days after I had done initial research. However, I had been late to the party so many times it feels like, I was just happy to find an opportunity that isn’t on every email blast from seeking alpha.

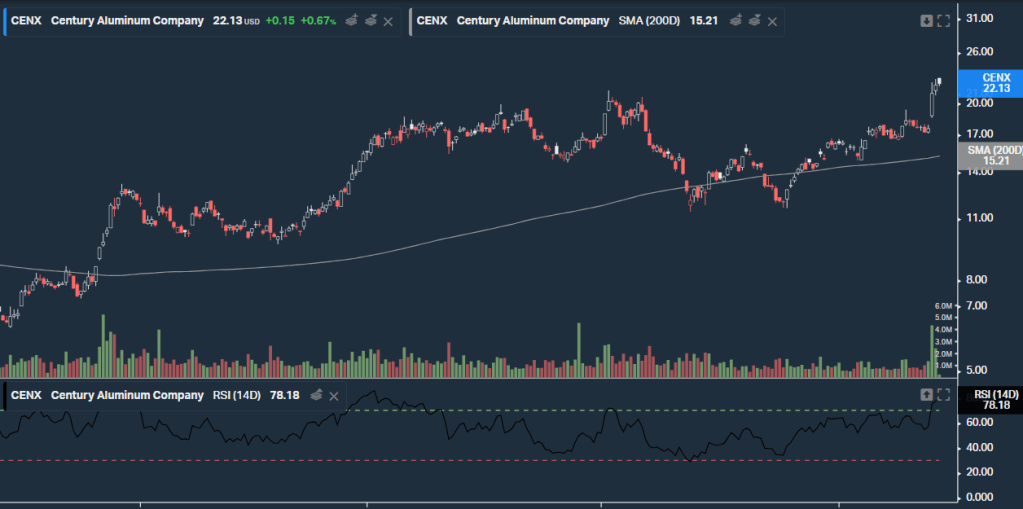

Thankfully I did buy the stock before the earnings. because it is ripping since the earnings call. The night of the earnings I saw the after hours was up 5% which was exciting enough, however it opened up and ripped to about a 23% gain that day, and another gain the following day by 3%.

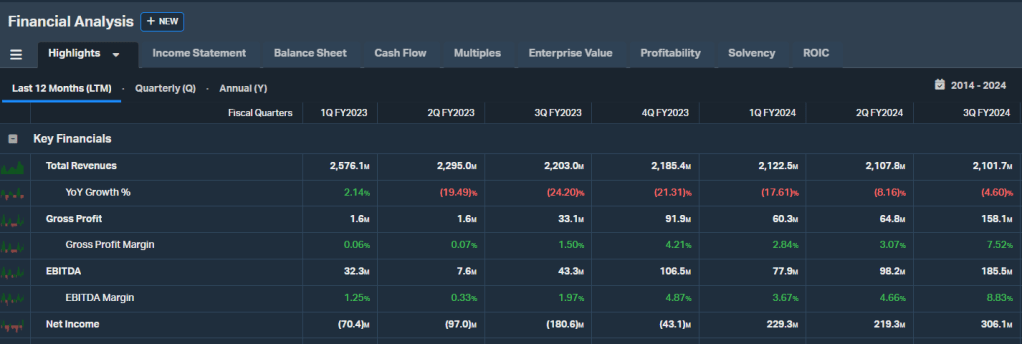

After looking through their earnings, the increase in aluminum prices really helped their profit margin and cash flow from operations. In an environment where aluminum prices are expected to stay elevated, and it does not appear that there will be a significant slow down in global growth, CENX should be able to maintain this performance.

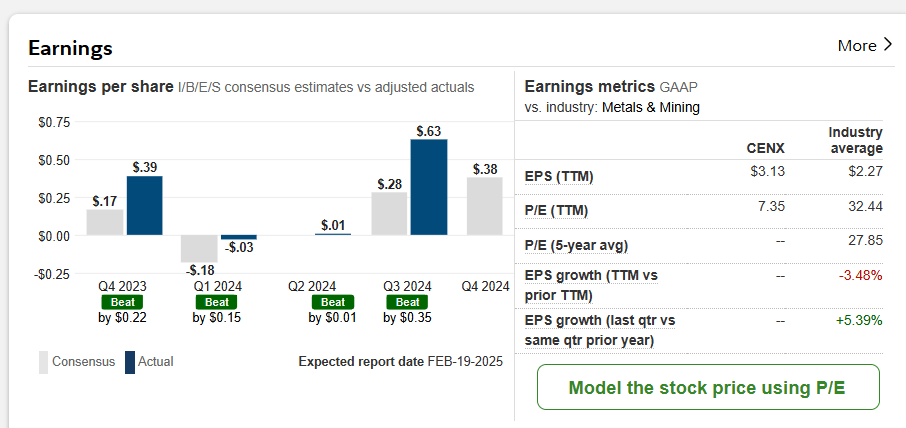

Below are the estimates and earnings the last 4 quarters and as you can see the Q3 earnings blew the expectations out of the water. CENX also compared to similar companies appears to be under valued. Their EPS are higher and their P/E is significantly lower, all the while it appears the company health is in good shape.

Hopefully I’m not a fool in this trade but seeing an immediate return on this, and potential for future growth and increase in valuation makes me feel confident in this one. As many wise people have said before, you don’t make money being right, you make money being right when everyone else is wrong.

As always, this is not financial advice and you should speak to a professional on any financial investment decision.