A tale told by many, the US Dollar is gaining traction and wreaking havoc on the global economy. Tourists travelling from the US to countries around the world may see it as a luxury to finally be able to afford the Burberry coat in London. However, for the rest of the world it is becoming more expensive to live. Below is what is known as the “Dixie” with the Ticker symbol being DXY. It is the USD index comparing relative strength to other currencies around the world.

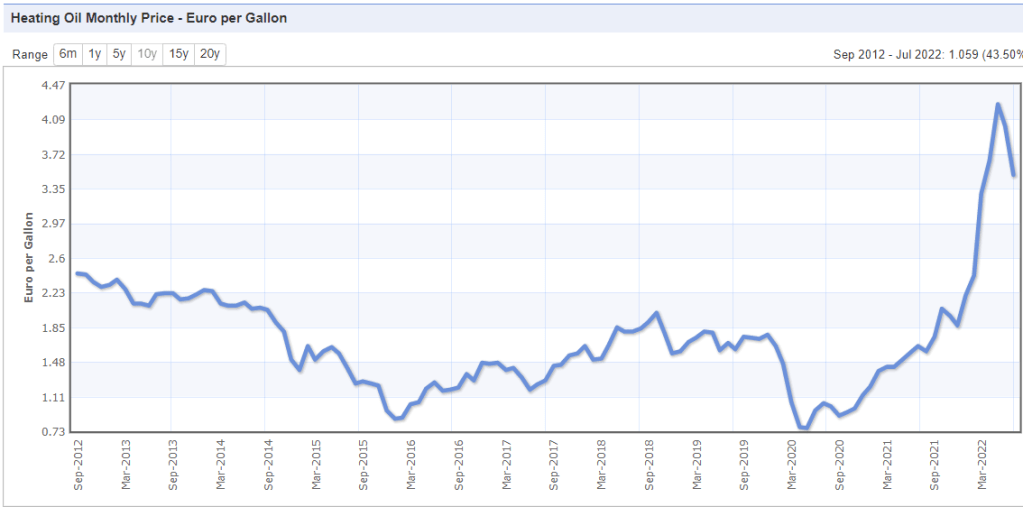

One company that is being evaluated on their future growth is our beloved Apple. It is one of our top companies that sells products around the globe and can be impacted by this strengthening dollar. They have already come out and reduced production/forecasted demand for the new Iphone14. People are not racing to purchase a new $900 Iphone when the cost to heat their flats across Europe is up over 100% from last winter.

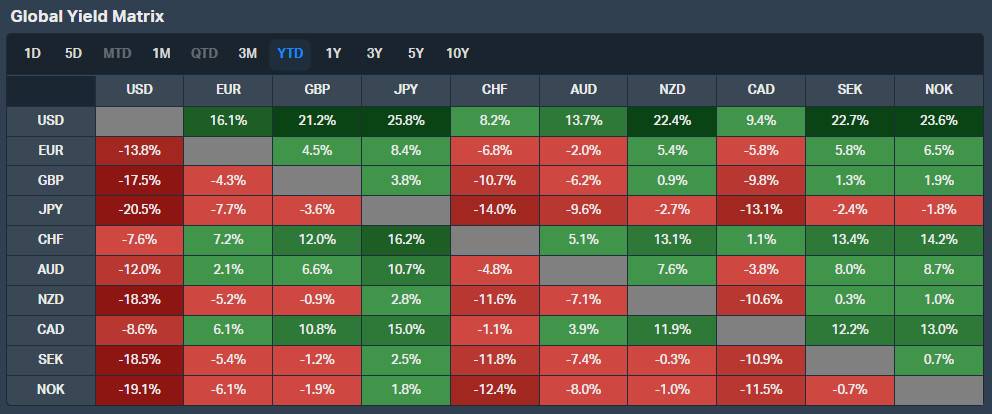

The Fed has continued raising interest rates to fight inflation in the U.S which has caused the dollar to gain this momentum against other currencies. Earlier this week the Bank of England avoided a liquidity event by running to the money printer, which increases the dollar strength further. The Currency market which has longstanding been a boring one is on fire the last few months. All you need to do to see this is look at the top row and first column of the heatmap below.

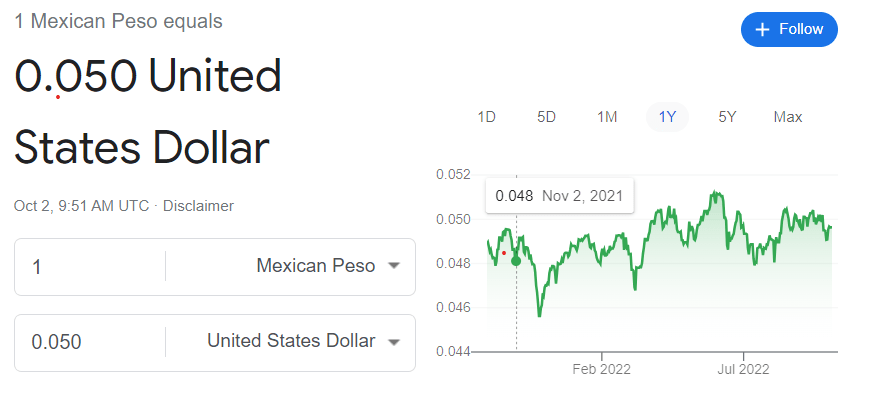

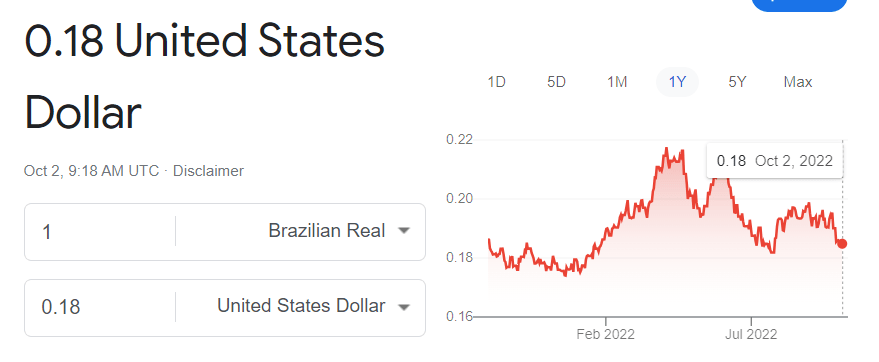

2 Currencies that have been holding their ground against the strong US Dollar is the Mexican Peso and the Brazilian Real. These two countries have a long history of inflation issues and took a more proactive approach after the pandemic. Mexico’s current Fed Funds rate is set at 9.25% and Brazil’s interest rate is at 13.75% in comparison to the US Fed Funds rate of 3.25%.

From a macro perspective the currents are crossing everywhere. There is political turmoil all over the world, China is entering a new phase of a housing crisis, Putin is annexing parts of a country that he is losing the ground war in, Credit Suisse is apparently having a Lehman moment, and the dollar is crushing global demand which in my opinion puts the Fed in a tough spot to crush the global economy or reverse course and potentially send equities skyrocketing and driving further inflation from the wealth effect.

How am I playing all of this? Well for the first time in a long time I have started to strategically get back into the markets.

I have bought some DBMF which is a Treasury Futures ETF that has been seeing some solid performance as yields rise. I have a bold move of buying VXX December calls @ $24, which is basically saying between now and then we will see a meltdown somewhere in the equities market that will drive volatility even higher than it currently is. I have also bought PBR which is a Brazilian oil company that focuses on the drilling and refining process. Not only has Brazil shown resiliency in the currency market, it has seen growth in revenues over the last year and appears to be run effectively by its leadership.