I’m happy to say I was able to avoid almost all the carnage that has occurred over the last few months. I saw the markets slowing down last December and went to almost an all cash position. It was only a few weeks later that the markets started to sell, and had one or two rallies to challenge the selloff.

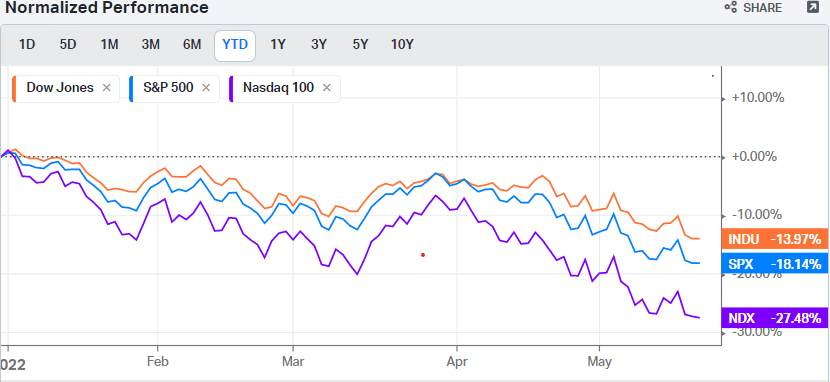

However, here we are almost 6 months into the year, and the Nasdaq is down 27.48%, DJIA is down 13.97%, and the S&P 500 is down 18.14%.

I hear a lot of people asking “is this the bottom?” all over the news. And honestly I don’t think it is. The Fed has hiked interest rates the last two meetings by 0.5% each time, and the market has sold off. On the second uptick in rates the market did attempt a rally when JPOW took off a 0.75% increase, but that doesn’t mean the tightening won’t stop. It wasn’t more than a day after that slight rally that the market whipsawed right back down 4%.

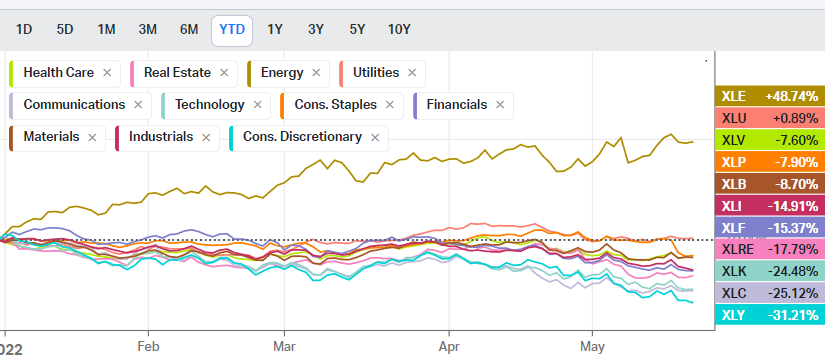

Of the major U.S Equities sector, the only significant gainer is the energy sector, and even that appears to be slowing down a bit. Russian oil has primarily been pulled out of the supply chain of the Western world, causing some added pressures. The U.S has attempted to dampen the blow at the pump to the U.S consumer by unloading some of the strategic reserves, however this seems like it is a bandaid on a laceration.

The energy sector will continue to go up until a large amount of oil starts coming from a new source, OR, and this is the scary option, the increases in rates force the economy into a major economic slow down due to higher unemployment rates, and less discretionary spending, causing a reduction in demand. The Fed has talked about a “Soft landing” somehow navigating this inflation boogey man, by hiking rates slowly and the economy and inflation will stabilize and we can carry on about our lives. However, this is extremely unlikely. We have hiked 1% interest rates in 2 months and have wiped out 20% of the market value…. And inflation continues to stay elevated. Not to mention the supply chains are still disrupted causing inflation to continue to linger.

With all this said I think we still have a ways down to go in the market. I don’t think the Fed can continue to hike before markets and money tighten so much that they begin to correct themselves. Analysts believe the Fed will raise rates to about 2.5-3% which is still 5-6 more 0.5% rate hikes. I believe it may take 1-2 more than that in order to break this expectation. If everyone thinks one thing, then the only way to break the bottom is to shock the majority populus.

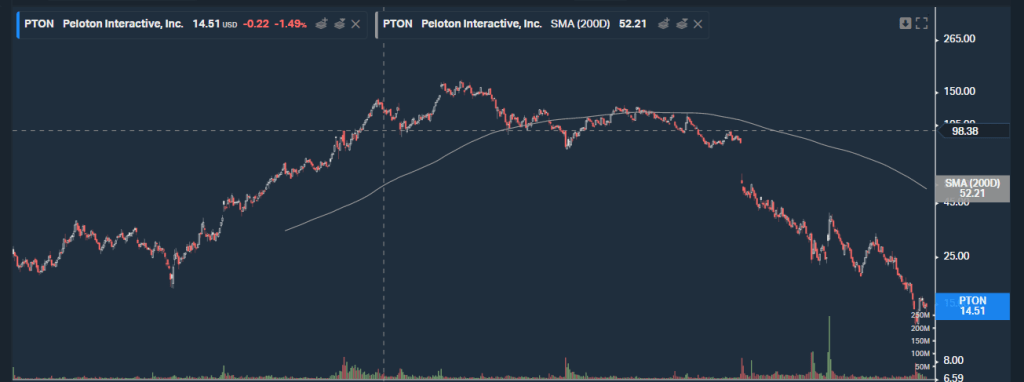

With all this said, the good news is that asset prices are starting to come back to normal. The ponzi schemes, the so called “future” stocks or disruptors, have started to come down to reality. The stock market was pumped full of these during stimulus checks and Quantitative easing, allowing these valuations to skyrocket out of control to P/E ratios that made no sense.

Peloton- look at poor peloton plummeting 90%.

Tesla- has lost about 50% of it’s value from it’s highs

And there’s so many others that have had similar trends.

This is not the time to Re-up on the tech stocks, this is the end of their bubble run. This bear market is going to continue to bleed in my opinion, and for now I will remain a bystander waiting with cash on the sideline ready to work for me when I feel the time is right.