It’s been a minute since I’ve posted as I have so frequently been taking time off from the markets and taking the time to plan accordingly. As the slogan on the website goes, “bulls, bears, and bystanders”, I have been more on the the bear/bystander side of the fence.

In “Reminiscences of a Stock Operator”, the main character Jesse Livermore says “Nobody should be puzzled as to whether a market is a bull or a bear market after it fairly starts. The trend is evident to a man who has an open mind and reasonably clear sight, for it is never wise for a speculator to fit his facts to his theories.” This goes hand in hand with the theory of travelling the path of least resistance. If the markets are strong, then you buy, and it it’s weak then you sell.

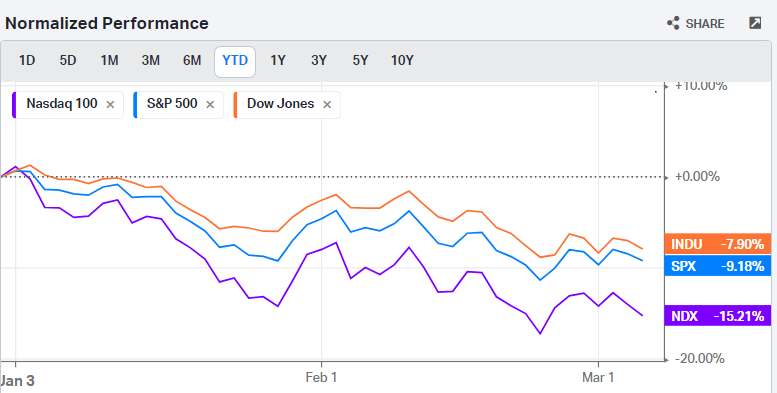

I stopped being bullish sometime last year, and although I was early to the party and missed out on a few points of earnings, I also missed out on the 10% wipeout of the markets at the start of this year. There is a lot of headwinds currently for the equities markets. The Fed is still signaling that they are going to hike interest rates this month. Terribly, Russia has invaded the Ukraine. And gas/energy prices are spiking around the world. The market appears to have entered a state where a slow bleed of asset prices is taking place.

There is going to be a lot of volatility in the market, especially as a Nuclear warhead wielding country is lobbing missiles into it’s neighboring country in Eastern Europe. This dynamic is going happen as long as this is happening. You may see rises of large percentage points speculating an end, and then another large drop when the next round of shelling/cities fall.

Although, I am pretty bearish equities, I have been bullish on commodities as prices are rising. I had previously owned WEAT which I sold prematurely, as the commodity has skyrocketed. Wheat is a large export of Russia which has helped push this commodity higher. Also, the cost of fertilizer has gone up over 100% and will force these prices even higher. Currently I am waiting to see if there will be a mean reversion in the price, where I would consider buying some options.

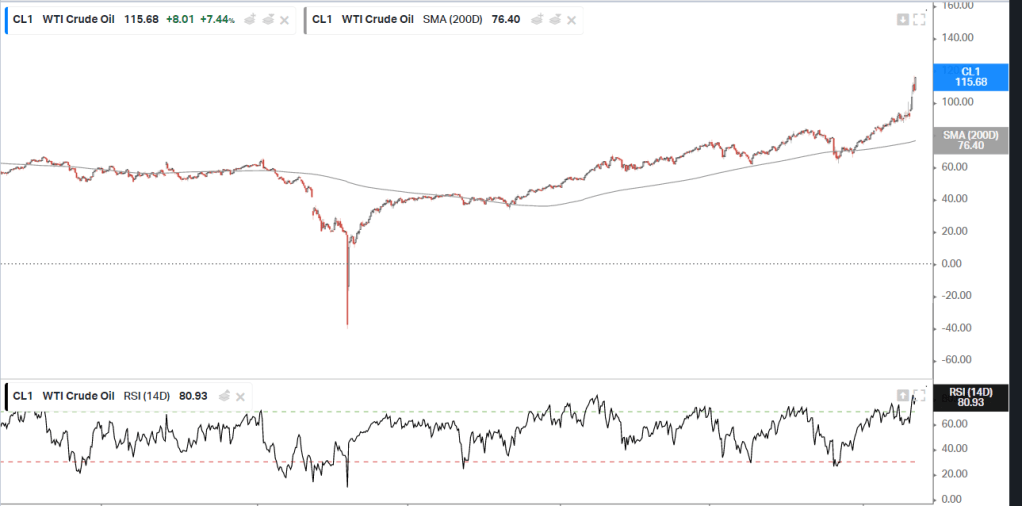

The big commodity that has everyone freaking out and talking about is oil. This thing has been an absolute bull since it’s low point around -$36/barrel during 2020. The oil prices have a few factors driving this increase, which many are way over my head, but they are good to be aware of.

For one, Russia is a large exporter of oil to Western European countries. Two, Green / Alternative fuel pushes have caught us between a rock and a hard place. For the record I am pro green/alternative, but there is a difference between what I want, and the way the world actually works. Three, there is a lot of money floating around still driving demand for everything forcing prices higher. My positioning in this are USO call options which have been very lucrative so far. My take currently with rising prices and my belief that commodity prices will inch higher is almost like a hedge on my personal spending. Food, buy DBA/WEAT. Oil, buy call options on USO. Corporations do this all the time to Hedge their prices, I figured in this environment, you could almost take the same approach

With everything going on there is also still the Fed and their potential for hiking interest rates. I personally believe the market is under estimating the Hawkishness of the Fed. I think J-Powell has been handed a shit sandwich and he has no other choice but to raise rates. Inflation has maintained very high levels with no real slow down recorded yet. Gas prices are rising, food prices are rising, there are a lot of supply and demand issues in the world. J-Pows choices are don’t raise rates and potentially let the market and prices run further out of control, or raise interest rates and really slow down the economy and limit demand hopefully slowing inflation and bringing it down to normal sustainable levels, but that comes with a cost.

In preparation for rate hikes and my suspicions that they have not been fully priced into the markets I have purchased put options on the Nasdaq ONEQ ETF. I think equities still have a good way to move downward and as long as I am not exposed to that downward turn I will be safe.