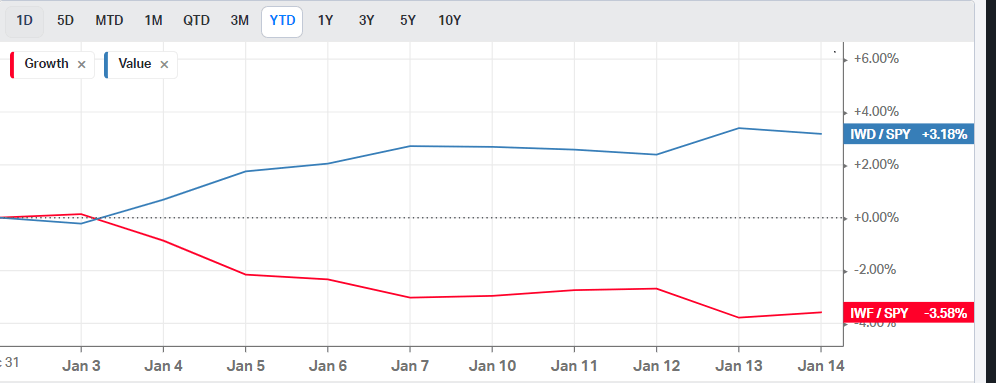

Since the start of the new year, we have seen a pretty good size rotation coming out of over-valued tech stocks and into value stocks. This is happening due to the hawkish-ness of the Federal reserves latest testimonies. Finally, it seems the markets are starting to take interest rate hikes seriously, and respecting that the Fed will more than likely start making interest rate hikes by March this year. In the chart below, from the YTD, you can see there is a difference of 6.76% between growth and value.

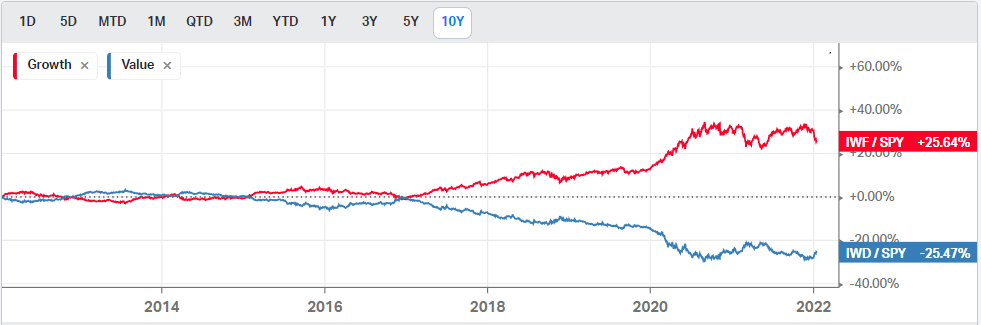

You can see in the next chart, there was a huge divergence between the returns of the 2 types of stocks. There is a difference of 50% between the 2, and that started really gaining traction around 2017.

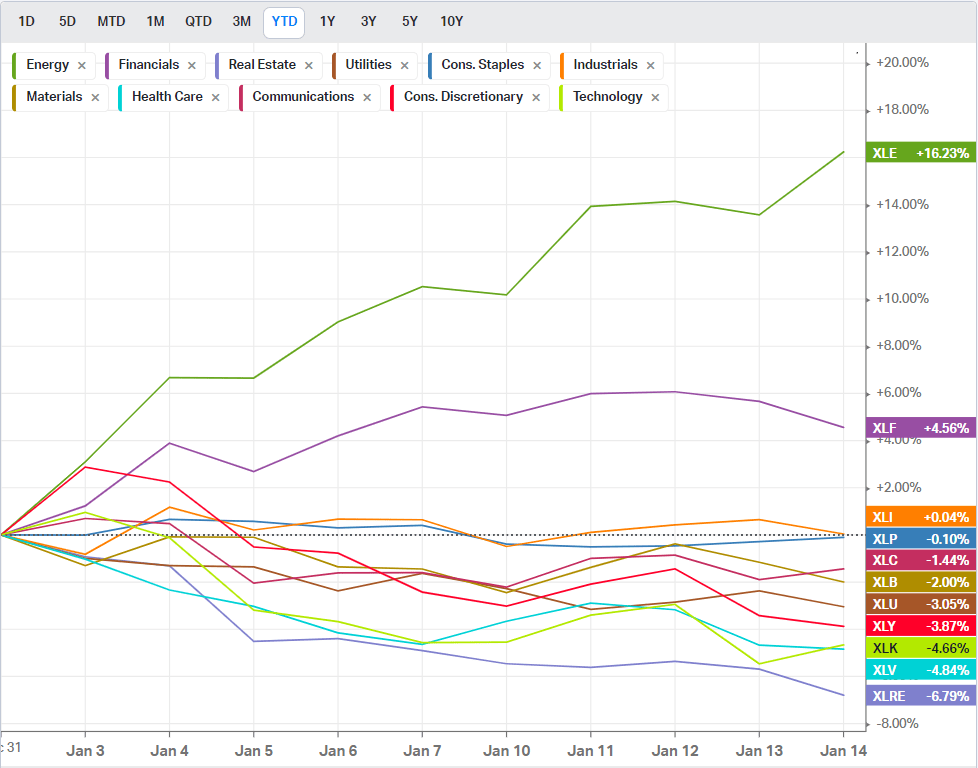

Since the start of the year, you can see a lot of money has been flowing into energy stocks with 16.23% increase YTD. Banks have been the next largest increase at 4.56%. Energy stocks are on the rise due to a lot of speculation about an energy shortage. There is obviously a lot of talk about the cost of heating and natural gas in Europe at the moment. A lot of the speculation piece comes from the stoppage/reduction in drilling exploration due to the green initiative. A lot of people think, at a certain point there shift to green energy will not be sufficient enough to keep up with demand. We are still heavily reliant upon oil and natural gas, and if we stop exploration/reduce production this could increase the prices of oil and gas. Financials are an obvious choice with the expected increase in interest rates. The banks will be able to profit more as it becomes more expensive to borrow from them.

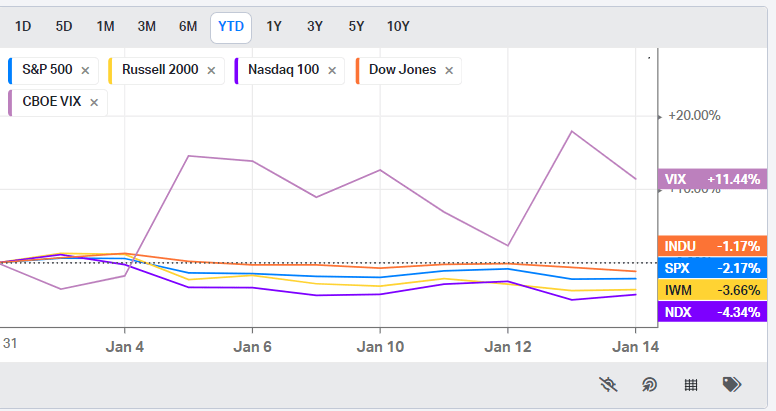

The next chart shows the performance of the big indices in the US YTD. Overall, with the rotation between growth and value the overall market has been able to remain relatively flat with no major selloff from a total value standpoint. One point to note is the increase in the Vix, which is a volatility index created by the CBOE. The VIX is a measure of the risk in the markets in the near term. I am currently long the VXX, which is a tradeable form of the VIX. Although it has a high cost of carry, the fluctuations can be dramatic, meaning a small investment could be an option to hedge in a volatile market.