To follow up on my last post…. never let the FOMO get the best of you. I have held out of buying TSLA for years… and yes I regret not pumping money into earlier this year at the stock split. However, the day after buying TSLA, Elon tweets a poll to possibly sell 10 billion dollars worth of stock, or something like that. Well Monday morning I sold it all at a very very minimal loss, and since then the stock fell about $200/share. The point is, don’t let emotions and fear of joining in or not joining in get the best of you.

Now, for my next theme that I’m looking at is something very much so not entrancing. It’s one of the most basic of basic things in this world. It’s not a flying car company, it’s not another Elon bubble, it’s Wheat.

Yes, I am actually looking at trading wheat. It might be the most boomer thing to ever come out of mouth. But, there are many factors that appear to be making wheat a very nice possible investment at the moment.

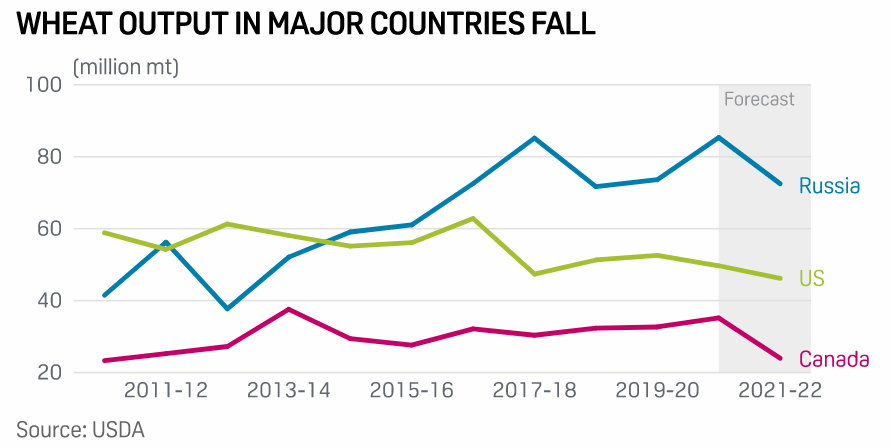

For one, some the largest wheat producing countries are actually producing less than past years. This is in part due to droughts across the midwest of the U.S as well as Canada.

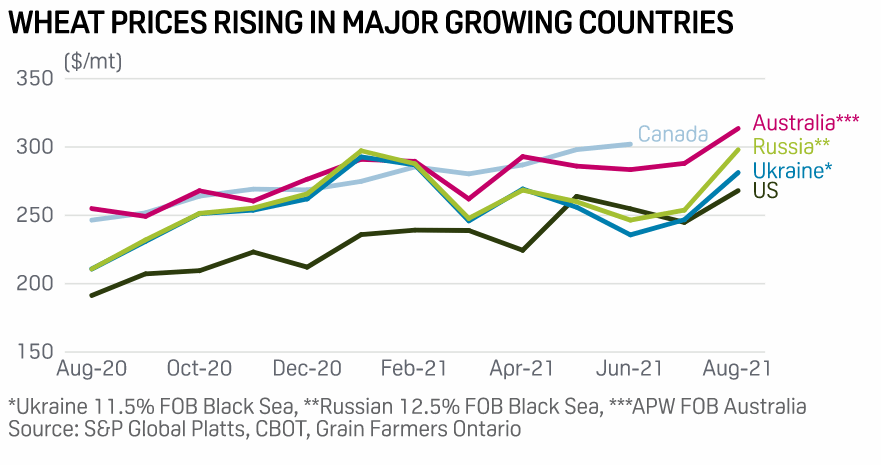

This shortage, in return has caused wheat prices to rise in these exporting countries.

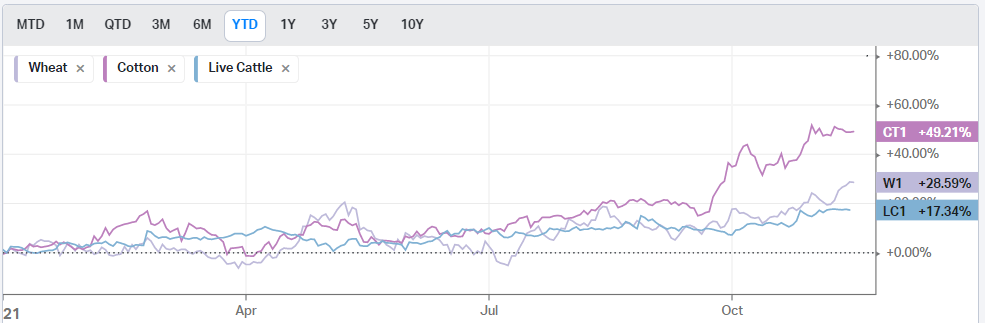

With other inflationary forces in play, Wheat is starting to tick upward in what appears to be a potential bull run. YTD it has increased by 28.5%, lagging behind cotton, but higher than many of the other essential grains/commodities. Wheat and other commodities can be a good way to hedge higher inflation. We have already seen inflation rise 6% YOY as of last week. With no real reason to think inflation is going away anytime soon, prices could very well continue to climb.

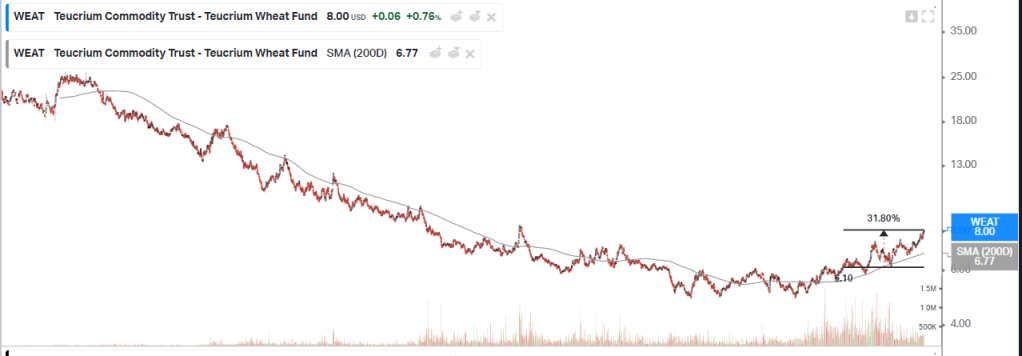

How am I looking to play this? I’m looking at the ETF, WEAT. It is a fund based on Wheat Futures contracts. From a short term and long term view, it appears that Wheat has bottomed out and beginning to see some upward momentum.

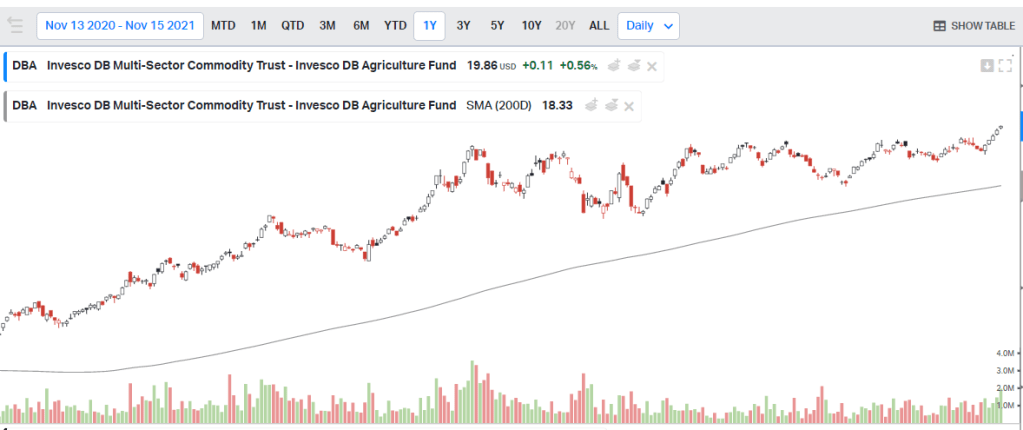

Another way I am looking to play this trade is with DBA. It is another fund based on futures contracts but of various commodities other than wheat, including soy, corn, cocoa, sugar among others.

Similar to the WEAT fund, it has performed at about 30% over the past year. I’m not sold on which one I will stick with but more than likely I will purchase a mix of the 2 in order to hedge my bet.

As usual, this blog is the opinion of the author and is not financial advice. You should always speak with a financial advisor prior to making any decision based on what you read on this blog.