The week in review

- The consumer price index (CPI) increased at a 0.5% M/M which was right at analyst expectations. Last months increase was at 0.9% M/M so we did some slowing in the inflation we saw in the month of June.

- Jobless Claims decreased W/W from 387K to 375K. This was the 3rd straight week of lower jobless claims.

- The $1.2 Tn dollar infrastructure plan and $3 Tn overall package was passed in the Senate and has moved on to House of Representatives.

- On Friday, the Consumer Sentiment Report came out much lower than expected and decreased M/M from 81.2 down to 70.2. This report is a survey in which people give their opinion on various factors of the economy.

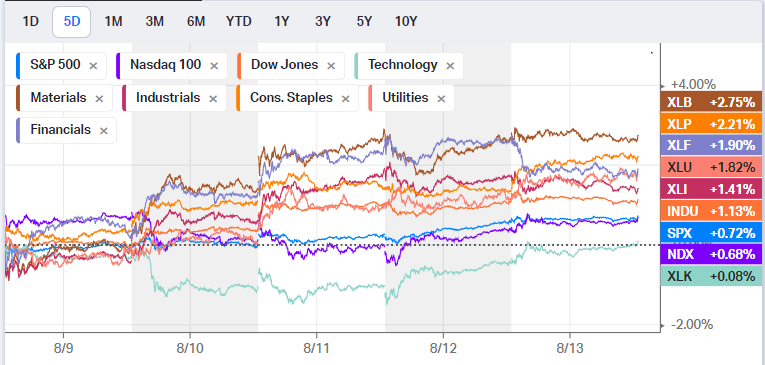

2 out of 3 major composite indexes finished green for the week with the Nasdaq being the outlier. This comes after a slowdown in major earnings reports from Tech companies having some big earnings reports come out over the last few weeks. However, broken out into the Nasdaq 100, that index did increase by ~0.6% during the week. This continues the trend of some of the big players in the index inching upward as the rest of the market sees some signs of weakness. In, my opinion I think we are starting to hit an inflection point with some of the tech stocks and see some consolidation in the markets with a sideways move in the Nasdaq. The DJIA, hit it big with the infrastructure bill passing and boosting Industrials in the overall market. The S&P500 inched higher as well at 0.72% over the 5 day period. In the chart below you can see Industrials and Consumer Staples being the biggest market sectors for the week. I think it’s important to not the dip and lateral move across the technology market at the bottom of the chart.

Where my heads at:

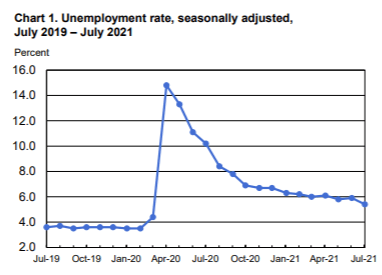

I’d be a fool if I told you I always thought the markets were going to go up. I think it’s important for traders to know what the market and economy are doing. For long term investors in indexes, yes, the market continues to go up so it is not as much of an impact if you’re planning on holding an index fund for 60 years until you retire. But if you’re looking for deals and finding the next hot stock/market, you should be “reading the room” if you will. With unemployment trending lower I think the market is starting to think that the Fed could be eyeing a rate hike in the near future. In my opinion, I think J-pow is targeting around 4% unemployment before starting to adjust interest rates. The chart below shows the unemployment rate over the last 2 years.

With Retailers reporting earnings this upcoming week and closing out the major earnings season of Q2, I think we are headed toward a choppy couple of months into October. The market has been running hot as the Fed wanted. Inflation has increased, unemployment has been trending lower, and money has been pumped into the financial system/economy to keep markets liquid and moving. I think many people fear, along with me, that many of the tech stocks have been seen as safe havens and have become extremely overvalued. With Tech earnings over, a global microchip shortage, and fear of a rate hike, I think we are going to see the markets stall out. I personally don’t feel the Fed will rate hike until Q2 of the next FY. They will let markets run it’s course through the holiday season and then conduct a rate hike after. I think sometime right around start of the next FY in the fall, so around late September/October we will see a large market pullback of around 10-15%, adjusting for expectations and pricing in what would be a rate hike. As always, this is just my opinion and not financial advice to panic sell everything and you should speak with a professional financial advisor before making any investment decision.

What I’m looking at for next week:

- Retail earnings of all major Retailers.

- Continuing jobless claims on Thursday

- Hoping to see a continued rally on stocks impacted by the infrastructure plan

- Tech/Microchip sector stock improvement. I am worried the tech sector is stalling and going to consolidate or retract.

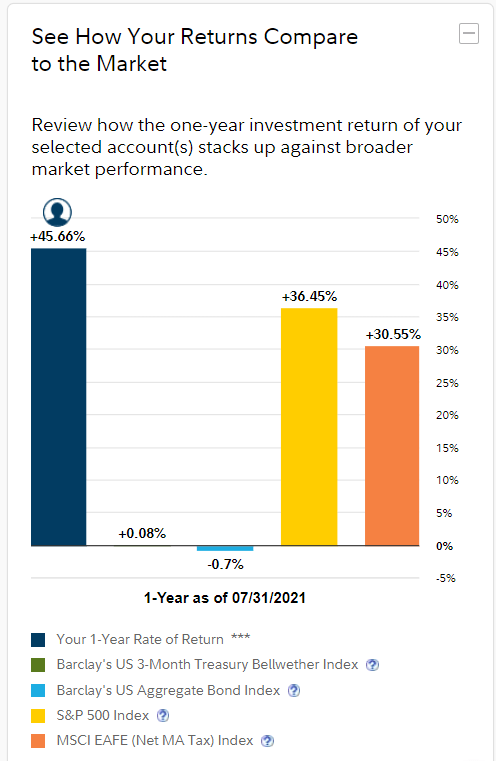

Figured I’d throw a chart of returns in here for validity purposes and to keep me honest with myself.

Disclaimer: Nothing on this blog should be taken as financial advice. You should always speak with a professional before making any financial investment. The topics in this blog are the authors opinion.